—— Inside the Wallets of Working Americans

Trickle-down effects:

A shaky foundation

The ability to plan for the future is an integral element of financial wellbeing. Unfortunately, many employees are currently unable to build strong foundations for their financial future - namely, in the areas of retirement savings and homeownership.

- Retirement savings

- Homeownership

Retirement savings

Retirement savings

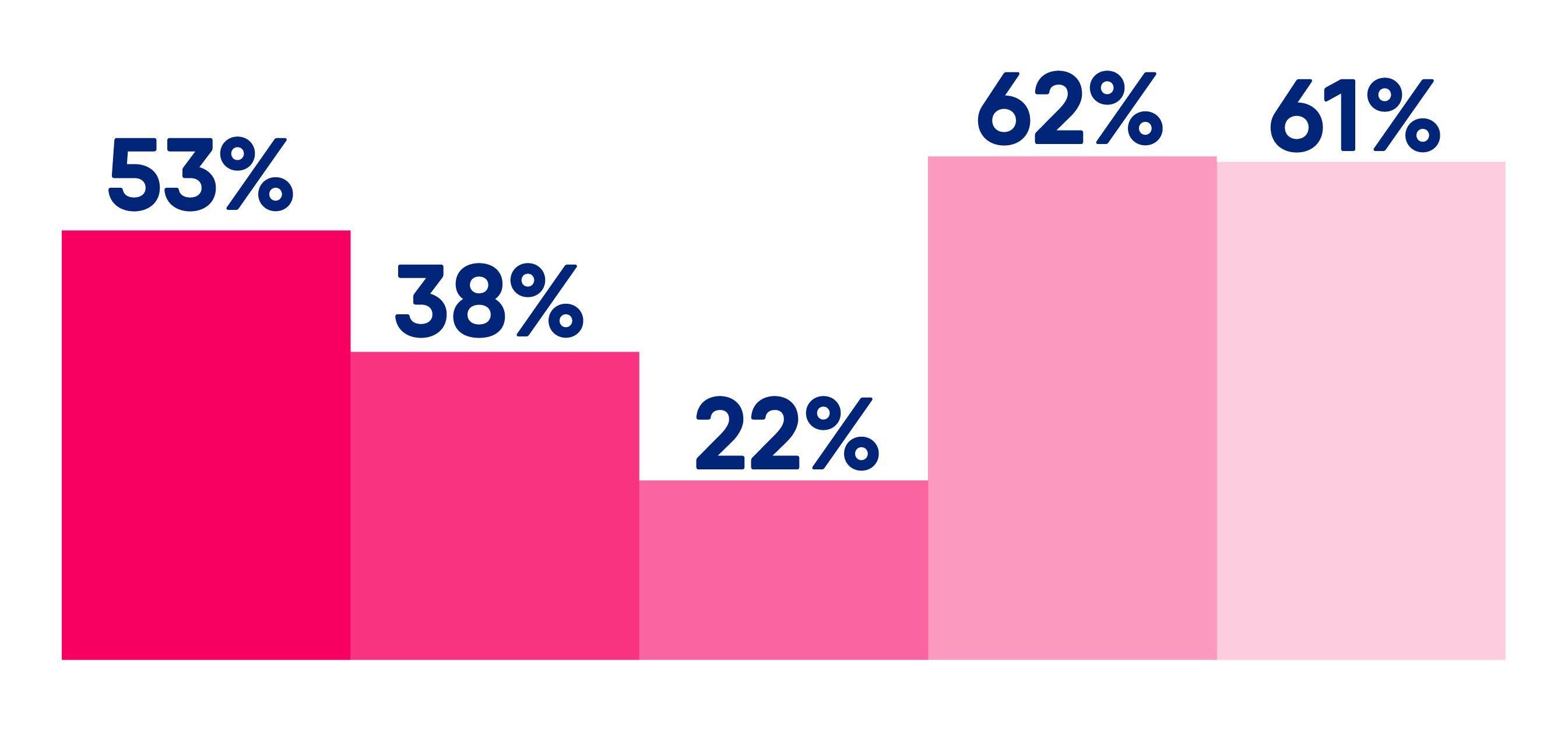

- 53% of people with retirement savings say they don’t know if it will be enough to retire on

- 38% say they aren’t making sufficient contributions to their retirement savings – 25% of people with a retirement plan reduced their contribution because of inflation

- 22% borrowed from retirement savings in the past year. 64% say that it was their least expensive loan option

- 62% of people are nervous that inflation will affect their retirement savings and/or timing to retire

- 61% of people are nervous that a potential recession will affect their retirement savings and/or timing to retire

Homeownership

Homeownership

-

55% of people who can't afford a home cite rising interest rates

-

Of those Millennials who don’t own a home right now, 42% of them said it’s because they cannot afford to, and 68% of them feel negative about that

-

56% of women can't afford a home due to rising interest rates

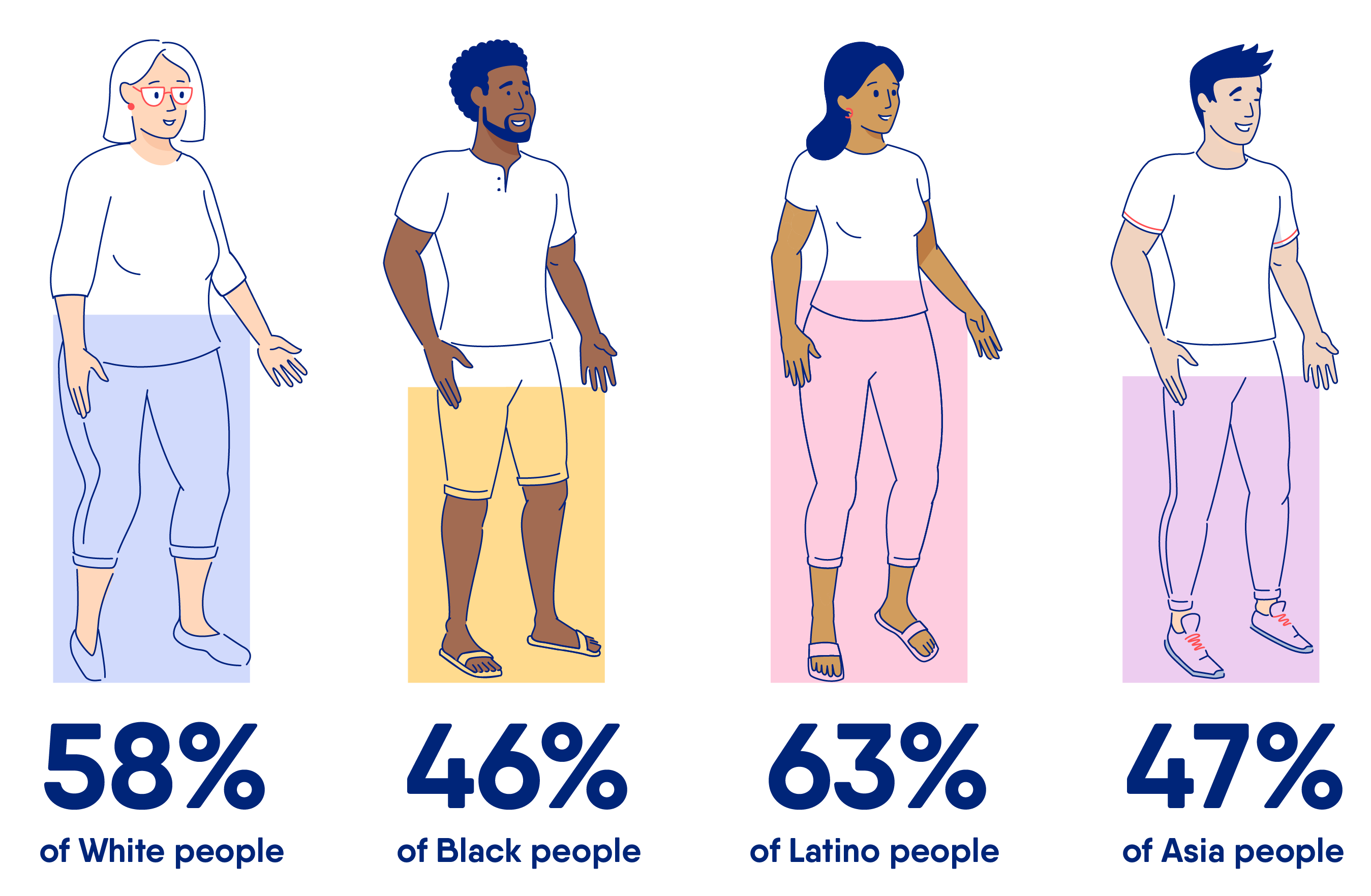

% who say they can't afford a home due to rising interest rates