—— Inside the Wallets of Working Americans

Trickle-down effects:

Lack of savings

Many employees are also struggling to save money, with 49% saying they’re anxious that they don't have enough emergency savings. 36% of all employees report that inflation has made them put off building emergency savings. Almost half (47%) have less savings readily available this year than at this time last year.

According to Pew Trusts, 60% of households experience at least one financial shock in a given calendar year. Since so many of these people don’t have emergency savings available, they’re forced to turn to high-cost online lenders (at 30%+ interest) or payday lenders (sometimes with averaging 400% interest) to make ends meet.

Women are worse off than men when it comes to this issue, with only 64% of women saying they have at least $1,000 in liquid savings, vs. 75% of men.

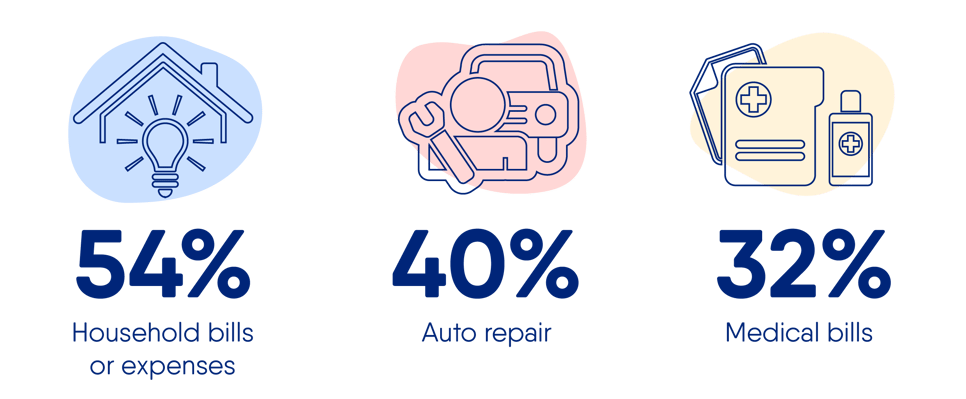

Of those who had to deplete their emergency savings in the past year, 63% have not been able to restore them to their previous level. The most common reasons people had for depleting their savings were: