When it comes to personal finance, the 50/30/20 rule is the method many financial advisors recommend because of its simplicity and ease. Traditionally, this involves allocating 50% of your take-home pay to needs (housing, groceries), 30% to wants (eating out, gym memberships), and 20% to future financial planning (saving, investing).

However, if you are living paycheck-to-paycheck, or are faced with income loss, this might not be realistic at this moment.

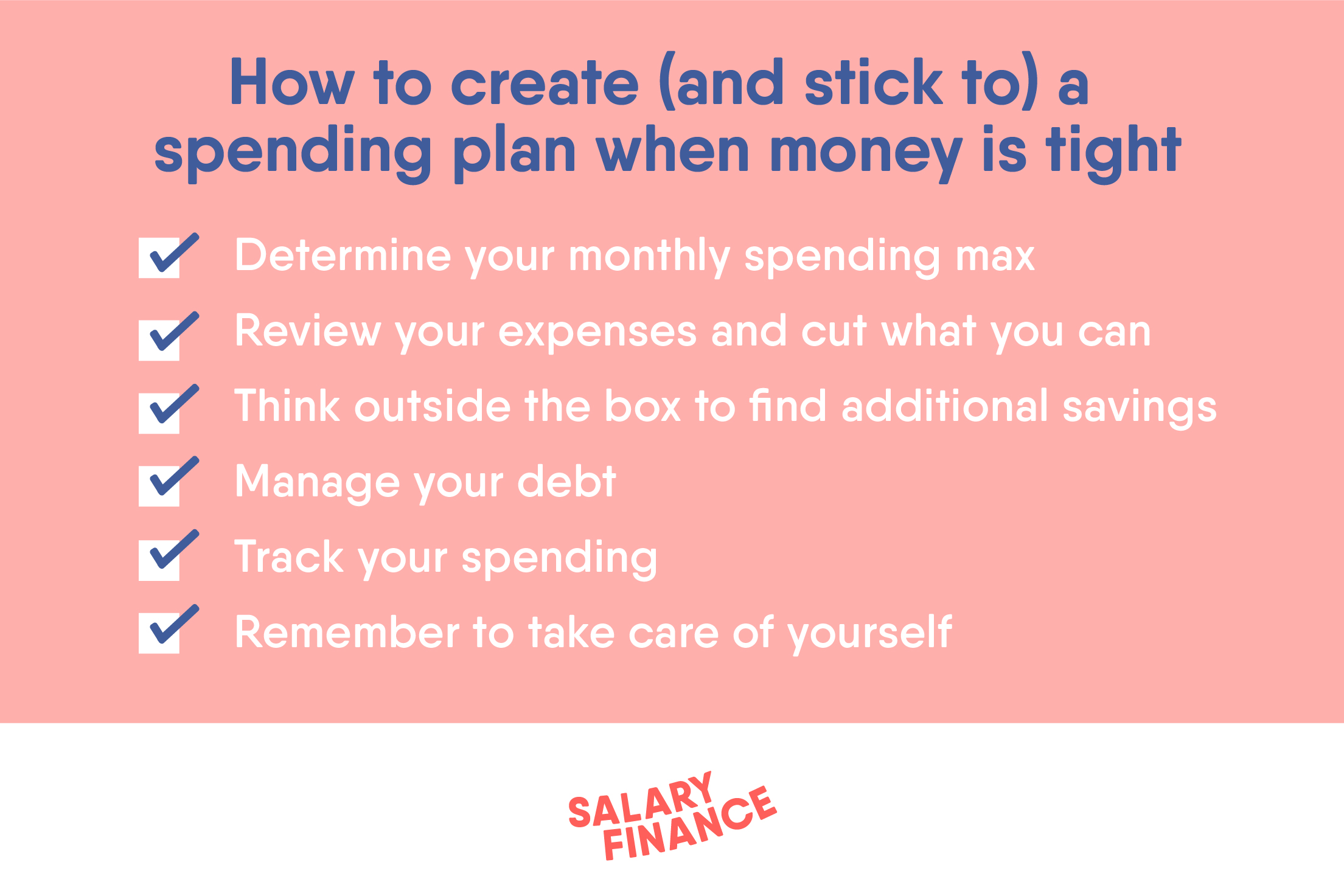

Here are a few steps you can take to create a realistic spending plan, no matter your current financial situation.

Step 1: Determine your monthly spending max

First, determine the maximum amount you can spend each month by adding up your take-home pay, unemployment benefits you are eligible for, emergency savings you can dip into, and any other additional support. Try not to include any credit lines, even if you have been relying on credit cards or overdraft fees to cover expenses up to this point.

It can be intimidating to see this number on paper, but once you’ve determined your personal monthly spending max, you can better evaluate how your past expenses stack up.

Step 2: Calculate your current monthly expenses, and eliminate what you can

Take a closer look at what you have put each paycheck towards over the past few months, and divide it into your needs and anything extra. Mint is a helpful free tool that allows you to import transactions from your online bank accounts for you to categorize.

Your needs include bills you must pay, like rent and utilities, as well as fluctuating costs, like groceries and necessary transportation.

Any extra expenses are opportunities to pare back your spending. You’ll find some expenses like subscription gym memberships, premium cable, and dining out may be easy cuts. In other cases, you’ll need to get more creative (see step 3).

If you can, include your money goals (emergency savings, extra debt payments, etc.) in that “needs” number so you tell yourself that they’re non-negotiable. But if your “extra” number is very small (or zero), that’s okay — do what you can for now.

Step 3: Think outside the box to find additional savings

After you’ve narrowed down your expenses, research other areas where you can save.

Start with your landlord or mortgage lender–you may be able to negotiate a payment plan, or refinance your mortgage. Many utility providers also have programs for low-income or unemployed residents.

Food is also a necessary expense where you can find many creative ways to save. Buying in bulk is a simple way to make your dollar go further, but it doesn’t always make sense if you’re single or in a couple. If you fall into one of those categories, reach out to friends, family, or neighbors to see if they would be interested in setting up a system where you buy the bulk items together, split them up and divide the cost with each other.

It is often helpful to have a friend or family member review your expenses as well at this stage – they may be able to identify some other areas you can trim that you may have overlooked.

Step 4: Manage your debt

Review your options on any loans you have outstanding. You may be able to defer, or lower, payments for a period of time. This will help protect your limited cash flow, but also protect your credit score and ensure your future financial health.

Do your best to limit credit card use, and find it in your budget to pay at least the minimum on them each month. Failing to pay the minimum amount on credit cards could negatively impact your credit score, and take a longer time to fix.

Avoid payday loans at all costs – this is easier said than done, but a predatory loan with exorbitant interest rates will only deepen the cycle of debt.

Step 5: Track your spending throughout the month, and celebrate your wins

Once you have taken stock of all of your expenses and trimmed down as many unnecessary expenses as you can, write down your spending plan and start tracking expenses.

There are a ton of free or low-cost smartphone apps and spreadsheet templates to help you maintain your budget. But whether you prefer digital tools or old fashioned pen and paper, keeping tabs on how your monthly expenses are tracking against your spending plan is key to your success. This not only helps you maintain accountability, it also will allow you to recognize your budgeting ‘wins,’ big and small.

Remember to take care of yourself

Money worries affect all areas of our lives. People with financial stress are 6.2x more likely to experience anxiety and 7x more likely to experience depression. It’s important not to put your physical and mental health on the back-burner while taking steps to improve your financial health.

Sticking to a spending plan may seem a lot easier said than done, especially when you are unemployed or have recently experienced income loss. Be patient with yourself, and keep trying until you find what works for you.

Salary Finance branded loan products are offered by Axos Bank®, Member FDIC. All loans offered are subject to eligibility, underwriting and approval. Terms and conditions apply. Salary Finance Inc NMLS #1750487. NMLS Consumer Access. Registered US address: 77 Sleeper Street, Boston, MA 02210