"Living in a spiral of debt"

Real stories from employees across the country, on how living with expensive debt or a lack of emergency savings impacts them and their ability to be happy and healthy, both in and outside of work -- and how their employers could help.

How I got here

During a typical year, most Americans are faced with financial shocks - defined as a significant loss of income or a major unexpected expense - with a third experiencing two or more. And since 68% of working Americans don’t have emergency savings, they’re often forced to go into high-cost debt to help cover these costs, which are typically around $2,000, costing the median household half a month of income.

What are these shocks? The most common is a car repair, and it ranges from that to unexpected bills from a medical emergency. But there are many shocks that could cause someone to need access to credit in an emergency.

Shannon's

story

“...a flood in the duplex where my daughter lives with my grandchildren. That cost me $23,000, so, it wiped out my savings and everything.”

Jenell's

story

"COVID was hard for a lot of people, I know for me it was… I didn’t travel in the summer like I normally [do, to] train teachers, so it put me in a bind… I lost out on about $10,000.”

Other

shocks

“Our water heater died and payday was

still a week out.”

What it feels like

Employees dealing with high-cost debt are more likely to be experiencing financial stress, making them vulnerable to depression, anxiety, and troubled relationships with family, friends, and coworkers. This also impacts them at work: 50% of employees with debt stress spend an hour per week on average dealing with debt-related issues at work.

Sarah's

story

"The stress that comes with financial insecurity, or even just knowing that things are weighing really heavy and you're trying to catch up on stuff can definitely impact your job… It just makes you feel like you're spinning your wheels a little bit.”

Carolyn's

story

"COVID took a toll on a lot of people, I was so distracted and kind of frustrated because due to the pandemic, I didn’t have any money coming in, but the bills kept coming."

Adriane's

story

“I was so stressed… worrying about making those payments on time because even if you miss a day they report it."

How I've made ends meet

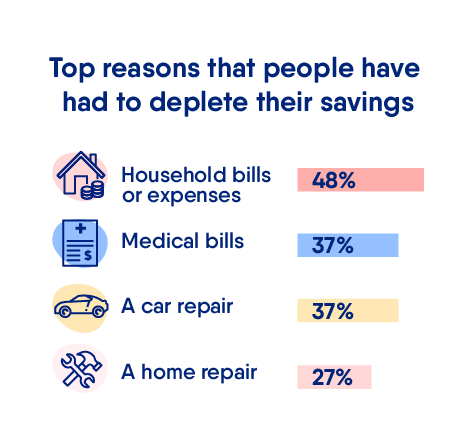

Depleting any existing emergency savings is often the first option when employees are faced with a financial shock. After that, many employees, especially those with subprime credit scores, are forced to turn to expensive sources of credit, especially sources where they can get money fast. Payday loans, pawn shops, and borrowing money from friends top the list.

Data from Inside the Wallets of Working Americans 2022 Report

Joshua's

story

"You take out a loan at certain places and then you make a payment and you still owe more than you did the time before… You’re going nowhere but downhill.”

Shannon's

story

“I've been in places and in the times of my life when I needed money, so all my stuff would go to the pawn shop.”

Carolyn's

story

“I have gone to the credit union and payday lenders to take out loans a few times… When I took out a $500 loan from a payday lender, I had to pay $400 back just in interest.”

How my employer could help me

In working with hundreds of leading employers in the US and UK, we’ve found that the most engaged employee populations exist in organizations where there’s openness and transparency about financial wellbeing and dedication to bringing awareness to benefits that could help employees.

Kelly's

story

By offering financial wellbeing benefits, Kelly feels that her employer is “showing how much [they want to] help you through catastrophes or just get caught up on your bills, so you don't constantly have to stay in the circle of paying your bills and [them] never going down.”

Monique's

story

Once her employer started offering financial wellbeing benefits, Monique said: “It just made me like my employer more because they’re not just paying me, they’re also helping me in the financial aspect as well as health aspect as well as mental health.”

Kristina's

story

“My goal is to become debt free and both my employer and Salary Finance are helping me to be well on my way.”

"Salary Finance is awesome. They were very helpful and considerate of my needs. Process was a breeze and funds were available in just 2 days. Will definitely consider doing business again."

Latosha R.

Some of these individuals were compensated for taking the time to share their story with us.